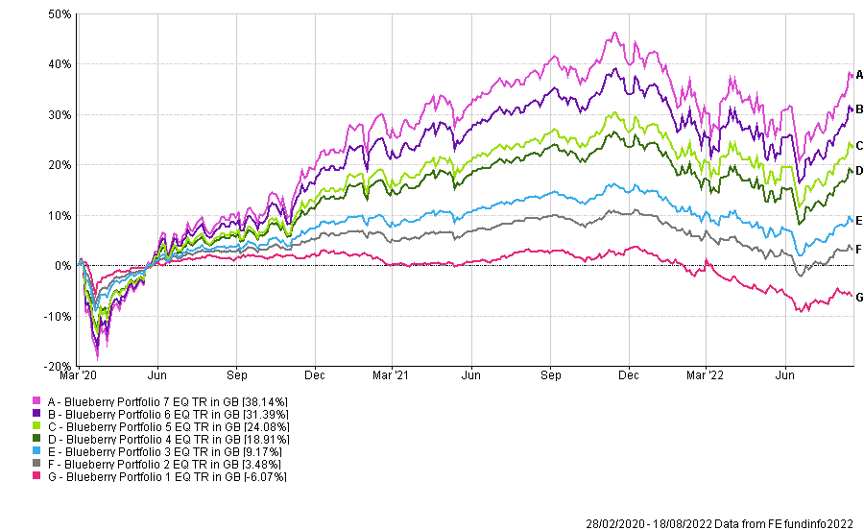

At Blueberry we have 7 portfolios to invest in. Originally named 1 to 7, 1 is the least amount of risk and 7 is the most.

If you want to invest some money, then it is important to decide where on this scale of risk that you sit. Your thinking may change as you learn more and as your circumstances and life changes.

Portfolio 1 is invested all in fixed interest. This is made up of gilts and corporate bonds. If the Government wants to borrow money, they can issue gilts – which are loans that pay interest. Companies can do the same and they are called corporate bonds. Generally corporate bonds have higher rates of interest than gilts as it more risky to lend to companies than the Government due to how will they pay it back.

Portfolio 7 is invested fully in equities (stocks and shares). An equity investment is money that is invested in a company by purchasing shares of that company in the stock market. These shares are typically traded on a stock exchange.

Equities are where the most potential for return is. The more equities you have, the higher risk your portfolio is, but the more potential for return it has.

The other 5 portfolios are invested in a mix of the two.

If you knew that you were investing in March 2020 and taking out the money in August 2022, then with hindsight, you would definitely go for Portfolio 7, but what if you had invested in November 2021 and wanted it back in June 2022? 😬

Things to Consider

- Time period – lots of years left to invest means you can take some volatility as you have time to recover from any dips

- How much – how much risk do you need to take to get the returns that you need for your plan?

- Change it – you can change it as you get braver or more cautious

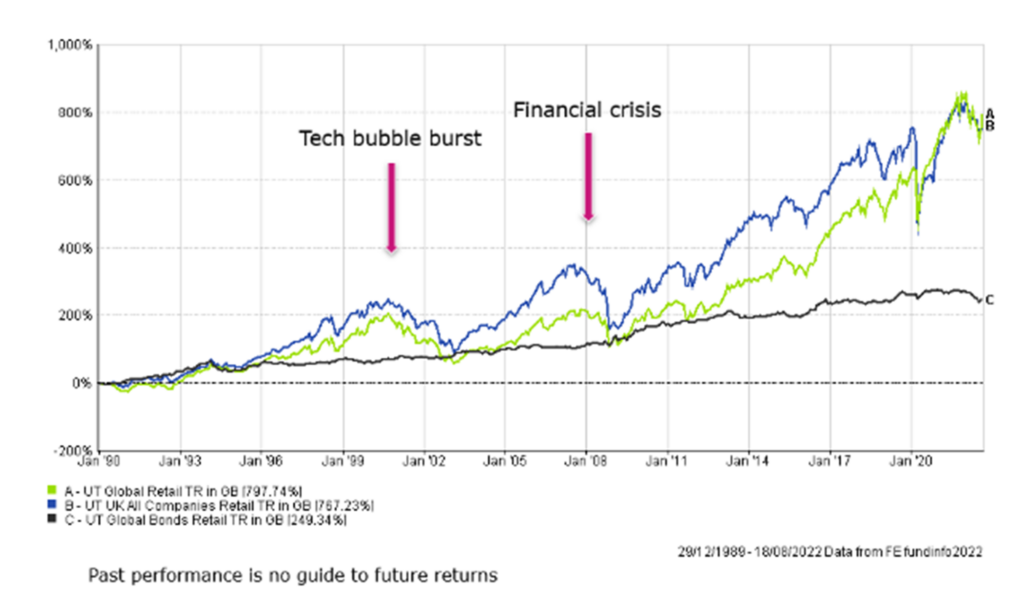

If we consider the last 30 years, we can see that what felt like massive events at the time, dwindle into small blips in the grand scheme of things.

Who remembers the tech bubble bursting in 2000 or the financial crisis in 2007/08? The papers were all screaming at the time that we were pretty much all doomed, and yet look now. Everything recovered and carrying on as if nothing happened. See the covid crash too?

Therefore, if you have the time to invest, then you can ignore any blips along the way. If you don’t need the money, then you can ride the waves.

On the other hand, if you know that you will need your money shortly, then maybe your safest route is low risk, maybe even cash.

There is no right or wrong answer when it comes to choosing your attitude to risk, just what you feel comfortable with and everyone is different. It is not up to me to tell you where that is, but help guide you to make the best decision for you.

Past performance is no guide to future returns.