Our investment philosophy

Our Investment Philosophy is based on academic research from some of the top investment researchers in the field, including Nobel prize-winning Economic Scientist, Eugene Fama.

Our Investment Philosophy is based on academic research from some of the top investment researchers in the field, including Nobel prize-winning Economic Scientist, Eugene Fama.

One of the most important investment decisions we make for clients is what assets to invest their money in. Asset allocation is the starting point for the investment strategy.

The reason why we emphasise asset allocation so much is Modern Portfolio Theory. This states that by combining different types of assets, the collective investment will have a lower level of risk than money held in a single investment.

Example: During a recession, equities usually fall in value, but bonds often rise; therefore, a diversified portfolio will be less volatile than one made up exclusively of equities.

Factor based investing is an investment approach that involves targeting quantifiable characteristics, or ‘factors’, that can explain differences in stock returns.

It involves tilting portfolios towards or away from specific factors, with the aim of generating higher risk-adjusted returns.

The factors are momentum, minimum volatility, quality, size and value.

If active fund managers were able to predict future market success, they would achieve higher returns over time, and not just in the short-term . . . So why doesn’t this happen?

Fund managers move on a regular basis and therefore can have little impact on managing your funds over the long term. Only 1 in 5 fund managers stay in charge of a fund for five years or more.

The efficient markets hypothesis argues that markets are efficient, leaving no room to make excess profits by investing since everything is already fairly and accurately priced. This implies that there is little hope of beating the market.

A study by WM Company, examined the probability of a fund moving from one performance quartile to another. Funds which are initially ranked in quartile 1 show no more than a random chance of being similarly ranked again.

Here at Blueberry Financial we select companies with good financial strength and levels of service, as well as funds that are low cost.

This means that your charges will be lower, so more money for you.

We don’t believe in paying for the fund managers’ Mazeratis and McLarens.

Ask 5 different economists what they think is going to happen to the markets in the next year and they will give you 5 different answers. None of them have a crystal ball, so they cannot see the future, they can only guess.

Look what happened in 2020 with the Covid Crash or 2022 when Russia invaded Ukraine and inflation and interest rates sky rocketed. No one saw those coming.

“Is now the best time to invest?”

We are often asked this as the markets could go up / go down.

If you try and time the market you could miss out on the best days for investment.

We are all aware of trying to be good and recycling more, using less plastic, using electric cars rather than diesel and caring more about the planet to slow down climate change.

How we invest our money can have a big effect on how we help to protect our planet. Blueberry Financial invest in companies that are not only good for the world but are also treating their employees and supply chains well.

In the past if you wanted to be ethical it meant that you were avoiding ‘bad’ companies, such as tobacco companies, those involved in oil, alcohol, weapons, gambling etc and as many of these companies were doing well you would get less growth than investing ‘normally’.

However, this no longer has to be the case. There are plenty of really good innovative companies out there who are working towards the good of the planet and their people. So, you can now invest in great companies, avoid the ‘bad’ and have the potential for great returns.

At Blueberry Financial we have seven investment portfolios for our clients that are made up of ebi and EQ funds. They range from Portfolio 1 which is low risk and is invested all in fixed interest and Portfolio 7 which is high risk and all in equities.

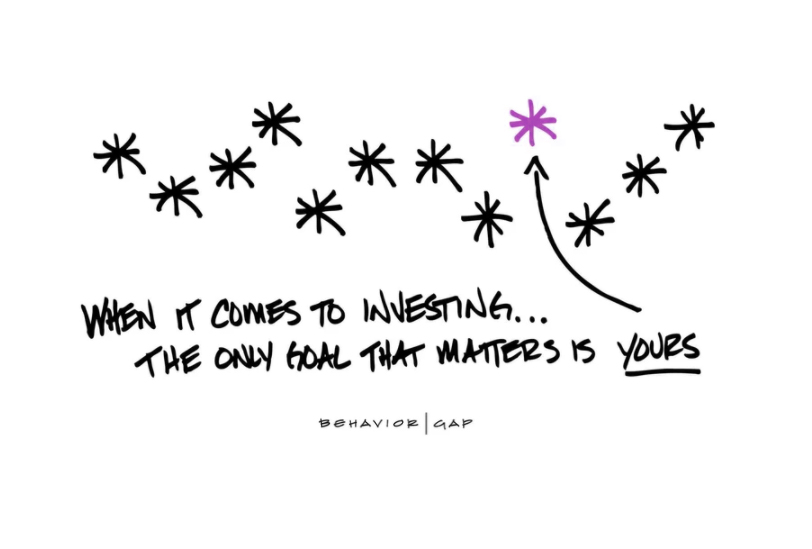

The dominant determinant of long-term, real-life financial outcomes is not investment performance. It is investors’ behaviour.

We use leading discretionary fund managers ebi and EQ to help you achieve your investment goals.

ebi is an innovative discretionary fund manager

The main reasons we have chosen ebi and their Earth Portfolios are:

1. ebi follow a similar investment philosophy to our previous portfolios but are evolved in some key areas.

2. ebi are a signatory of the United Nations Global Compact (UNGC). All of the underlying funds in the Earth suite apply filters to screen companies to ensure alignment with the UNGC. This screening leads to lower exposures in terms of Carbon Involvement and non-ESG Product Involvement compared to the wider market.

3. ebi keep their costs down by having access to share classes of funds that are cheaper than the share classes you would normally be able to gain access to, so ebi’s charges are effectively cancelled out. They also only rebalance their portfolios when necessary, keeping the costs down there too.

4. ebi constantly monitor their portfolios to make sure they are fulfilling their goals and performing the best for their clients.

EQ is an award-winning discretionary fund manager focused on sustainable and impact investing

The main reasons we have chosen EQ and their Positive Impact Portfolios are:

1. EQ Positive Impact Portfolios invest in solutions to social and environmental challenges, such as climate change, access to education and clean water and to actively engage for change towards a more sustainable world. This investment strategy has a dual focus on maximising both impact and financial returns.

2. EQ Investors is 21% owned by their sister charity, the EQ Foundation. Being part owned by a charity means that a proportion of their profits will always go towards supporting good causes. Since 2015 they have donated over £2,000,000 to charities.

3. EQ are currently among the highest scoring B Corp’s in the UK and as a staff-owned business, creating an inclusive culture is paramount to their success.

If you have any questions about our approach to investing and how we manage your money, please get in touch.

Madeleine sat down with Damien Lardoux, Portfolio Manager at EQ Investors, to speak about the importance of sustainable investing, the performance of ESG investments, and what sets EQ Investors apart.

See the full conversationWant awesome financial insights delivered straight to your inbox? Of course you do.