I am doing lots of work on reducing Inheritance Tax (IHT) at the moment for clients and so wanted to share a solution with you that could be great for everyone. Especially as in our last newsletter I shared a video about how IHT works.

If your estate is over £500,000 as an individual or £1 million as a couple, then your beneficiaries will probably have to pay inheritance tax, which is 40%.

I have just had one client who would be leaving his kids with a tax bill of £800,000 if nothing is done. That is a huge amount of money to be giving to HMRC and let’s face it, whilst our taxes go to lots of great things, it is wasted on many things too, regardless of which political party is in power. Keep the money for you and your family, don’t give it away because of a lack of planning.

Wouldn’t you like to keep the money for your family and

also contribute to saving the planet?

There is an awesome product out there called an IHT plan (brilliantly named!!)

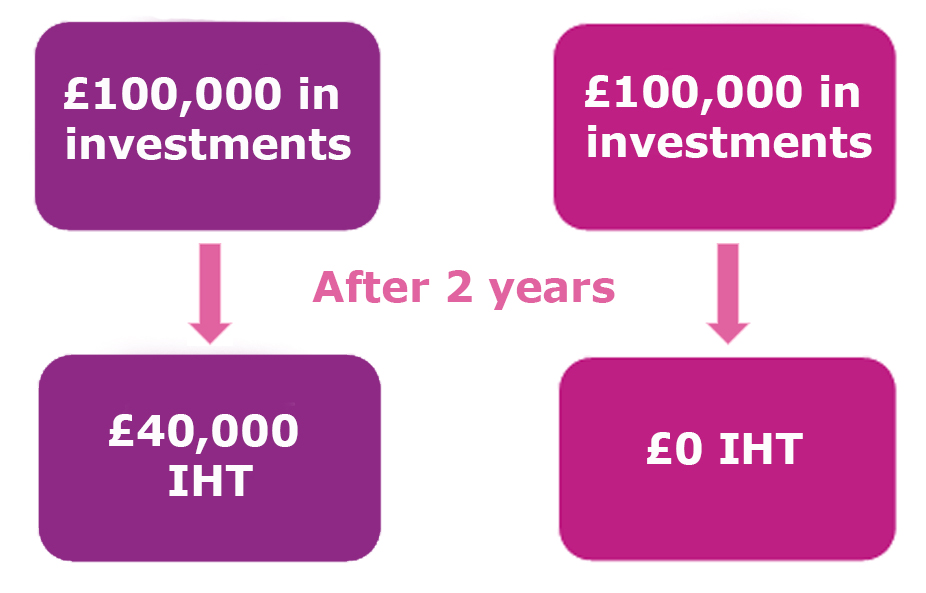

It invests your money in companies that qualify for BPR (Business Property Relief). If you hold these companies for two years or more at your death, then the money in them is completely free of inheritance tax (IHT). Whoo hoo!!

There are two types of these plans: risky ones that invest in companies on the AIM (alternate investment market) and others that invest in companies that are looking to achieve about a 3% return every year, after charges).

Lots of these products also invest in renewable energy, so trying to save the planet too. I was listening to Bill Gates Book on How to Avoid a Climate Disaster (which is well worth the read / listen) and he says that we need to build solar and wind farms 5-10 times faster than we are already, in order to achieve our renewable energy targets. So according to that, then this would be a great place to have your money . . .

The money stays in your control, as if you want the money back then it is yours, unlike if you had gifted it away. Also, if you had gifted the money then you need to wait for 7 years for it not to be included for IHT, rather than the 2 years for these products.

These plans are not trying to be super amazing, they are just trying to get 3 – 3.5% return every year, after charges, which is so much better than any of us are getting in a bank account. And they can save your beneficiaries £ thousands.