Many more people are thinking about Inheritance Tax (IHT) planning now that the lovely Chancellor has said that from April 2027 pensions will come into your estate for IHT.

There are 3 main ways to lower your IHT bill:

- Spend the money

This is by far my favourite one and one that I tell my clients all of the time to do. You worked hard to earn your money, so why not spend it on yourself and enjoy the fruits 🫐 of your labour?! Experiences though people, not useless plastic crap.

- Gift your money

This could be to your children, your grandchildren, charities, good causes, friends, the list is endless. You could gift it to them directly, put the money in trust for their later use or set up pensions for them. Remember that these gifts are potentially exempt transfers and so are only free from IHT after 7 years.

- Inheritance Tax (IHT) Plans

You can put your money into IHT plans. The money is still yours and you can take it out whenever you need it or want to use it, but after 2 years the money is not subject to IHT, as long as it is in the plans when you die.

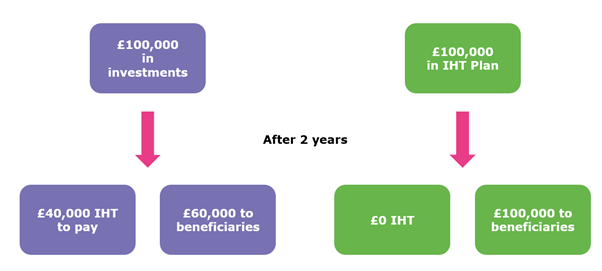

So let’s say that you have £100K. If you have it in a bank account or ISA, for example, on death it would be subject to 40% IHT (assuming that you have used up your IHT allowance already). So your beneficiaries pay HMRC £40K and they get to keep only £60K. HMRC are very happy!!

If you had put that £100K into an IHT Plan, had it invested in there for 2 years and held it at date of death, there would be no IHT to pay so your beneficiaries would get the full £100K and HMRC would get nothing!!

Worth considering . . . ?

They are obviously not right for everyone, have risks of their own and it depends on your individual circumstances, but please let me know if you would like to chat about these as they could be a good option for you if IHT planning is on your mind.