The stock markets have had a rubbish year, inflation has gone up and interest rates with them, which means that all of our mortgage rates have increased too (stop being smug if you don’t have a mortgage😝!!)

So why am I not crying and drinking vodka every night?

Because we have seen it all before and it will get better.

I was reading the Spectator this week and they were saying that it isn’t just that interest rates have gone up, and therefore our mortgage rates, but “it is the uncertainty of where they will peak that has borrowers and lenders panicking. Only two months ago, markets expected rates to peak at 4.5%. Two weeks ago it was 5.25% per cent. Now it’s 6 per cent.”

We changed our mortgage rate in March of this year and we are now paying more on an interest only mortgage than we were paying on our repayment mortgage. Annoying, right?!

So what do we all do?

We need to be nice to ourselves and realise that things are currently more expensive than before. Take a look at your expenses and see where you can make savings (I got rid of our TV licence last year as we do not watch any live TV or BBC iPlayer – I only got it back for Eurovision). How much is your house insurance – you can often make savings there? Pretend to be me for an hour and look at everything that you pay for and question it all. What is unnecessary and can go?

If you have to reduce your saving / investment contributions for a time to give yourself a bit of breathing space, then do this. You can make them back up at a later date. Call me for a chat if you want someone to talk it through with.

Next think about the stock markets and your investments.

If you are still contributing, then your pension contributons are still getting tax relief of 20% for basic rate taxpayers and up to 45% for higher rate tax payers. £80 into a pension for a basic rate tax payer gets £20 tax relief from HMRC, so you can lose 16% of your pension and be in the same place as if you had invested in a bank account with a 4% interest rate.

Remember too that the markets will recover and then your investments / pensions should be way above any bank account.

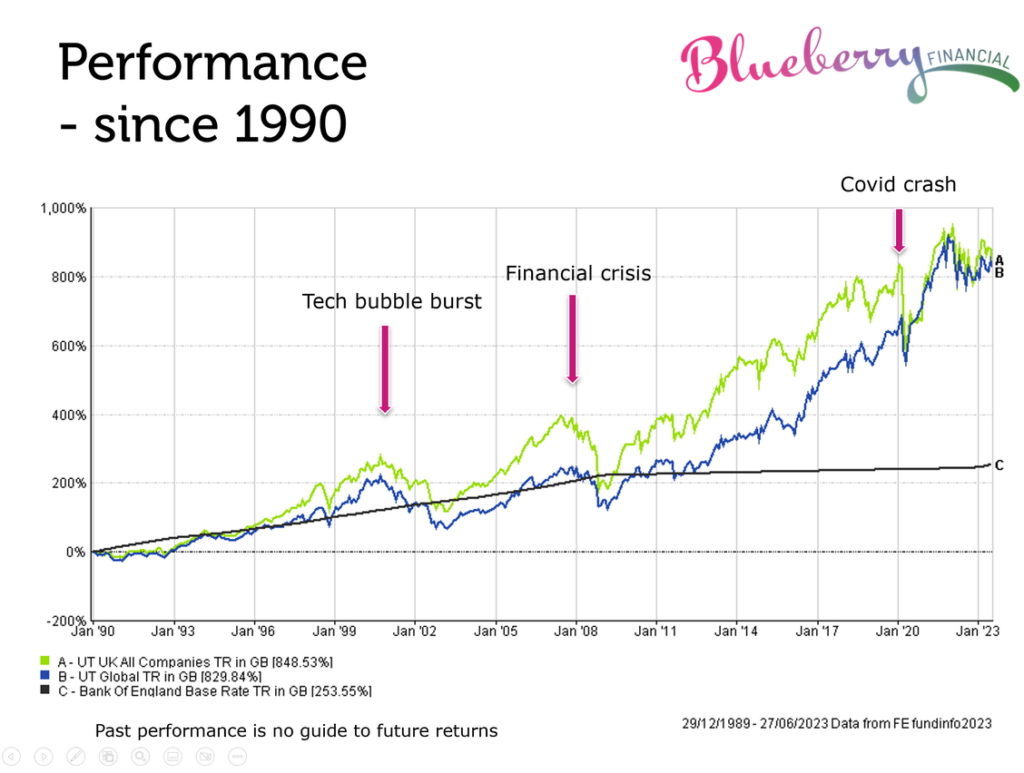

Look at the chart below to see how the Bank of England Base Rate has compared to investing in UK and Global Equity over 30 years. Even with the dips at the three points shown, they were just blips on the investment horizon, and whilst they seemed bad at the time, they quickly recovered. So keep going, it will all work itself out.