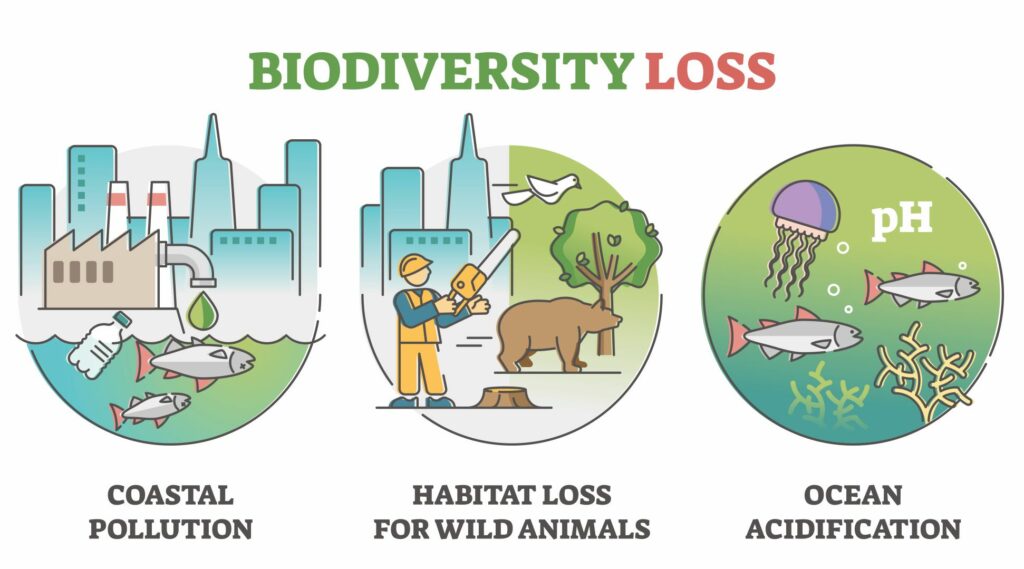

Biodiversity is the variety of life on our planet. The many different species of life. Scientists are warning that 1 million species out of an estimated 8 million are threatened with extinction, many within decades. Without biodiversity we will not have clean air, fresh water, good quality soil or crop pollination.

This is why the European Parliament wants to have legally binding targets to stop biodiversity loss.

At Blueberry Financial we use EQ Investors in our portfolios for the ESG (environmental, social, governance) element of our investment philosophy.

EQ Investors avoid many business models driving biodiversity destruction, which are also climate change drivers. These include fossil fuel extractives and unsustainable agriculture.

EQ Investors encourage all fund managers to bring biodiversity into strategic engagement conversations with companies, to encourage policies and processes to prevent destruction and restore nature, and measure it.

They also select funds that invest in companies providing novel solutions to reduce biodiversity loss or even support its restoration, although there are not yet many.

Examples include:

- The circular economy

The Regnan Global Equity Impact Solutions fund invests in companies avoiding new material production and associated impact on biodiversity, such as Befesa and Tomra Systems.

- Alternative materials

The Ninety One Global Environment fund invests in safe alternative bio-based and degradable chemicals and ingredients, such as Novozymes and Croda.

- Planet-compatible diets

The Baillie Gifford Positive Change fund invests in Beyond Meat, avoiding biodiversity loss associated with intensive and/or animal farming.

- Sustainable utilities

The Fidelity Sustainable Water & Waste fund invests in companies treating waste and wastewater, and abstracting water responsibly, such as Pennon Group, Clean Harbors, Evoqua.

- Sustainable natural forest management and conservation

The Allianz Green Bond and Wellington Global Impact funds invest in green bonds issued by developing banks protecting natural ecosystems.